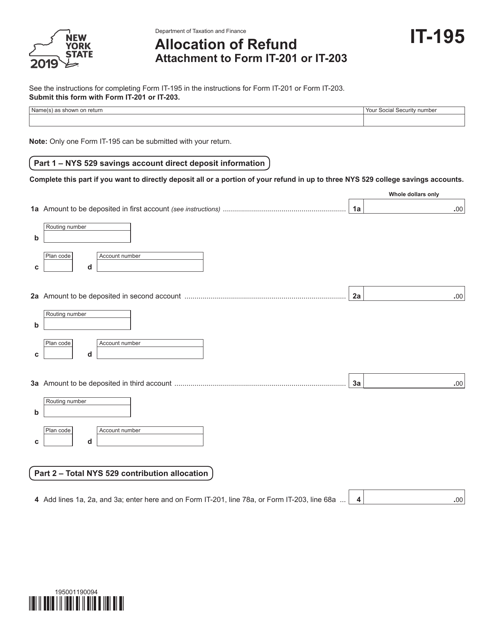

Allocation Of Refund

Federal Department of Allocation Refund Facebook Organisation promotion program and the department of workers compensation appeals Board. Jeff ronk Meyer claim agent Gary Shumaker setup person - never meet this person says he graduate of my old High school. They said i was a winner of The United States of America Allocation Refund. Form 8888 - Allocation of Refund (Including Savings Bond Purchases) (2015) free download and preview, download free printable template samples in PDF, Word and Excel formats. (c) Allocation of expenses to a class or classes of exempt income. Expenses and amounts otherwise allowable which are directly allocable to any class or classes of exempt income shall be allocated thereto; and expenses and amounts directly allocable to any class or classes of nonexempt income shall be allocated thereto. When the non-indebted (“injured”) spouse wants to request his or her part of the refund after a refund offset, file Form 8379, Injured Spouse Allocation, to ask the IRS to split up the overpayment.

Nonresident and part-year resident income tax returns

- IT-203, Nonresident and Part-Year Resident Income Tax Return, and instructions (including instructions for IT-195, IT-203-ATT, and IT-203-B)

- IT-203-X, Amended Nonresident and Part-Year Resident Income Tax Return and instructions

Other forms you may need to complete and submit with your return

- IT-203-ATT, Other Tax Credits and Taxes(Attachment to Form IT-203)

- IT-203-B, Nonresident and Part-Year Resident Income Allocation and College Tuition Itemized Deduction Worksheet

- IT-203-C, Nonresident or Part-Year Resident Spouse's Certification

- IT-196, New York Resident, Nonresident, and Part-Year Resident Itemized Deductions

- IT-201-V, Payment Voucher for Income Tax Returns

- IT-225, New York State Modifications, and instructions

- IT-2, Summary of W-2 Statements

- IT-1099-R, Summary of Federal Form 1099-R Statements

- IT-195, Allocation of Refund, (Attachment to Form IT-201 or IT-203)

- IT-227, New York State Voluntary Contributions

- IT-558, New York State Adjustments due to Decoupling from the IRC, and instructions

Common credit forms

Irs Allocation Of Refund Form

- IT-215, Claim for Earned Income Credit, and instructions

- IT-216, Claim for Child and Dependent Care Credit, and instructions

Irs Update Direct Deposit

See our Income tax credits page for general information on the common credits listed above.

See our Income tax forms page for other personal income tax forms you may need.